Navigating the Complex World of Insurance for Young Drivers

Navigating the complex world of insurance for young drivers can be daunting. Whether its your first time driving and youre obtaining insurance for the first time, or youre an experienced driver and dont have the gift of years in the insurance world, this in-depth guide will help you tackle the complexities of car insurance for young drivers head-on. Does shopping for car insurance feel like a chore? We’ll show you how to make it an empowering experience, and at the same time put a few bucks back in your pocket.

The cost of car insurance for young drivers varies drastically based on your driving history, the type of car you drive and the insurance company you sign up with. Car insurance companies typically weigh risk with premium meaning the more risk you exhibit the higher you premiums. Factors such as having a poor driving record and young age increase the chances of risky behaviour. However, there are policies that can lower your costs.

Check your coverage and shop around. Understanding the ins and out of car insurance doesn’t need to be a full time job. Comparing the costs of different policies can save you money. Check what your policy does and does not cover. It is important to consider what type of policy you need, endless deductibles, and least amount of cover.Its also wise to look out for special discounts such as low-mileage discounts, for young drivers who drive less than the standard 12,000 miles per year.

Raise your deductibles. While raising your deductibles will undoubtedly cause your monthly premium to decrease, the upfront cost in the event of an accident can be a steep financial burden. Thus, you are advised to consider other methods first.

Overlook credit options. Depending on where you live, rate-evaluation options such as pay-as-you-drive, or pay per mile, allow you to pay for your car insurance premium based on how much you drive. So, less use of your car equates to lower premiums and vice versa.

Further, you can save money by opting for a telematics device. Telematics offers a way to reward drivers for good behaviour by monitoring things such as speed and braking behaviour. Depending on the provider, you can receive discounts of up to 30 percent for driving in a safe manner.

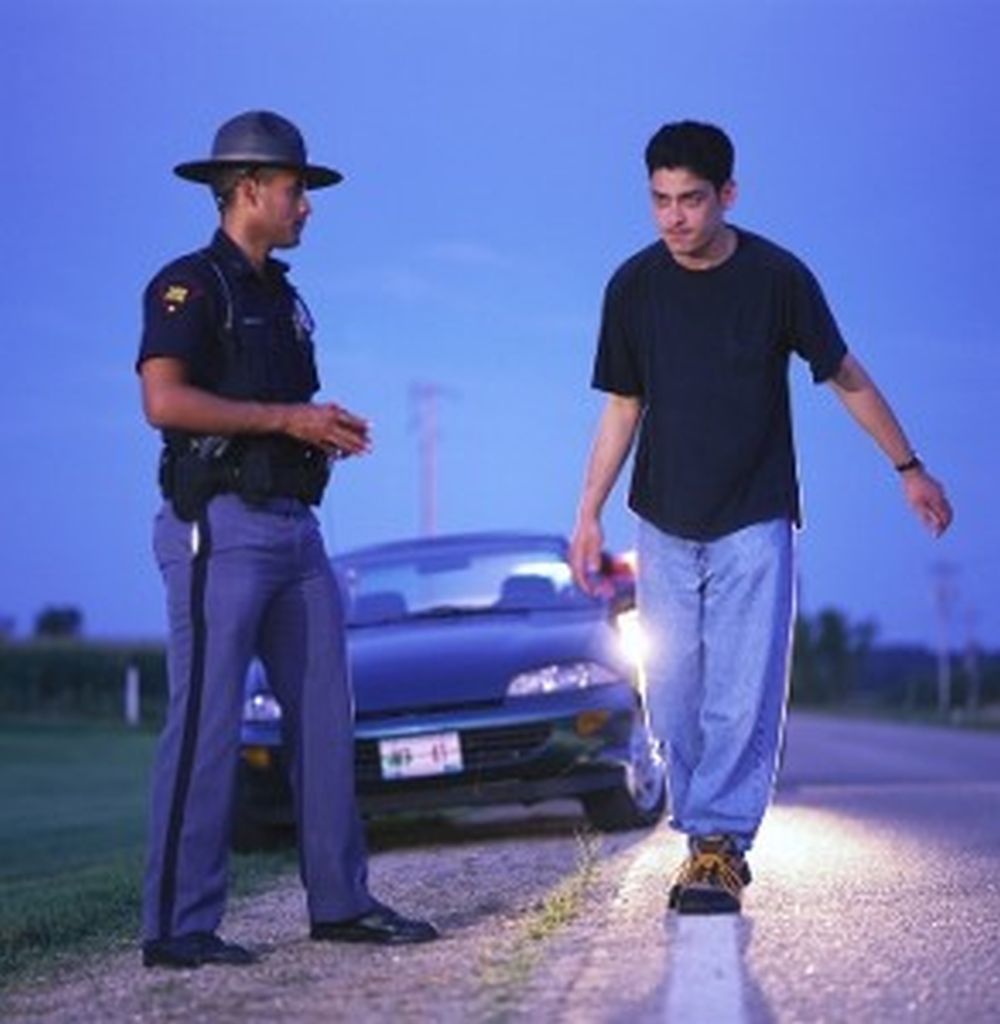

No one should neglect safety measures. A great solution for young drivers is to enhance safety and lower costs, is investing in a defensive driver course. In some states, doing so can your premium by reducing the risk you represent to an insurance company.

Once you have the basics covered, you can look to other methods to reduce the cost of maintaining your car. Research the basic maintenance options for your car. You can easily reduce costs with preventive maintenance, including Regular oil checks, tire rotation, brake checks, etc.

For young drivers just getting started in the car insurance world, it may look intimidating. However, taking the time to understand the basics and staying up to date with trends and strategies are key to getting the most out of your car insurance.

Make sure you focus on repair costs as much as purchase prices. Choose a model that you can zero in on with repair parts quickly and easily. Consider the cars design and safety features. Comprehensive coverage is especially important for young drivers, so assess those features and their cost when selecting a vehicle.

For young drivers on a budget, the cost of running their car can appear too high. However, you can reduce your costs by staying informed and being proactive about how you shop and insure your vehicle. Research the market for deals and discounts, and consider other forms of cover, such as Third Party Only, which could be cheaper.

Good grades don’t just help with college applications. In some states, having good grades can get you discounts from insurance companies. Many insurers offer good student discounts just for maintaining a good grade point average.

Be sure to research the areas you may be uninsured in. Many drivers dont think about protecting their car if its not in use during an extended period of time; insurers often will not provide coverage. If youre parking your car at home for at least 7 days out of the month, you may need to invest in storage insurance.

Insurance is an intricate and complex process. But by understanding how to shop for the right insurance, young drivers can make their insurance experience easier to navigate. Take the time to compare offers and do your research, and youll be sure to save money and secure the best coverage for your needs.

When looking for discounts, consider joining an association or organization related to your profession, as membership may qualify you for a lower rate. If you take the time to investigate your options, youre sure to find a policy that can save you money on car insurance and help you prepare for the future.

If you drive a car for business purposes, consider getting business car insurance, which can combine coverage for both your business and personal life. Some freelance workers can obtain the same coverage, as long as the vehicle is not used for more than 30 days for business purposes.

Nurture young learner drivers. One of the best ways to help new drivers avoid making costly mistakes is by encouraging them to seek out mentors or driving lessons. Teaching them to seek out reliable instructors who can teach safe practices is key to ensuring they become safe, responsible drivers.

If youre a modern driver, you shouldnt overlook modern technology. New cars are being fitted with telematics, a system that records vehicle performance and potential issues. By signing up for a car tracking system, you can choose to receive alerts when your vehicle requires maintenance and show insurers youre a responsible driver.

Try non-standard policies. If youre a young driver, its likely youll pay higher premiums than experienced drivers. Some insurers offer non-standard coverage, which creates an alternative policy for those who are unable to access standard policies. This method usually involves higher deductibles but when combined with a multi-car policy, you could pay less than you would with a standard policy.

Review your coverage options. Each state has its own individual insurance requirements, so drivers need to familiarize themselves with these requirements and review what they can and cannot cover. Make sure youre familiar with the risks and coverage options available to you before buying a policy.

Dont miss out on additional discounts. Insurers are constantly looking for ways to incentivise drivers and make car insurance more affordable for young drivers. Keep an eye out for any extra discounts that you may qualify for such as usage-based programs and loyalty discounts.

One of the most important factors for young drivers is to remember to be courteous on the roads. Start by following the speed limit and avoiding distractions while driving. Being safe on the roads will go a long way in ensuring youll attract a lower rate at renewal.

If youre under 25 and own a car, comparing coverage rates and car models can save you money. Doing so will help you make informed decisions and compare the cost of different policy limits and features. Dont forget to find out about discounts, such as multi-car discounts for households, and ask if insurers offer any incentives for safe drivers.

If youre a student, you can probably get discounted rates. Many insurers offer discounts to students and if the vehicle is parked on or near campuses, you can often find cheaper rates. If you carpool, you can even get discounts for having passengers in your vehicle.

The journey to becoming an informed young driver doesn’t have to be intimidating. Knowing the basics, and having a better understanding of the car insurance market can save young drivers money, while also providing the peace of mind that comes from having the right coverage. By taking the time to compare policy options, and understanding the potential discounts you can qualify for, youll be equipped with the knowledge to make the best car insurance decisions when making your purchase. So take a breath, and remember, youve got this!