Making Sense of Insurance Options for Young Drivers

When it comes to owning a car, young drivers often feel overwhelmed and confused when it comes to making sense of their insurance options. Unfortunately, car insurance rates are generally higher for inexperienced and untested drivers, but there are ways for young drivers to find the coverage they need at an affordable price. Here are some tips for understanding insurance options for young drivers.

First, know your budget. A good place to start when researching car insurance is to determine what kind of coverage you can afford. Deciding how much premium you can pay on a monthly basis will help narrow down the list of companies that might be available to you. This can help guide your search when determining which company best meets your needs.

Second, know the coverage that you need. Not all car insurance policies are equal. Make sure you know what type of coverage you want to receive in order to meet your individual needs. Do you need liability only, or do you need full coverage? Understanding the differences can be time consuming, but is a necessary step in finding the best insurance rate.

Third, shop around. There are a number of different insurers that offer car insurance to young drivers. Get quotes from as many insurers as possible to compare rates. Compare both premiums and deductibles to find the best coverage for your particular situation. You may even be able to negotiate premiums with insurers who are trying to win your business.

Fourth, consider discounts. There are different discounts that may apply to young drivers. For example, good student discounts can save you money if you maintain a certain grade point average in school. Also, if you bundle with other insurance policies such as homeowners or renters insurance, you may be able to receive discounts. Make sure to ask about potential discounts when you get quotes from insurers.

Fifth, look for safety options. Many insurance companies award discounts to drivers who have safety features on their vehicles. Make sure you understand what safety features will qualify you for discounts and determine if you can make upgrades to your vehicle in order to get them.

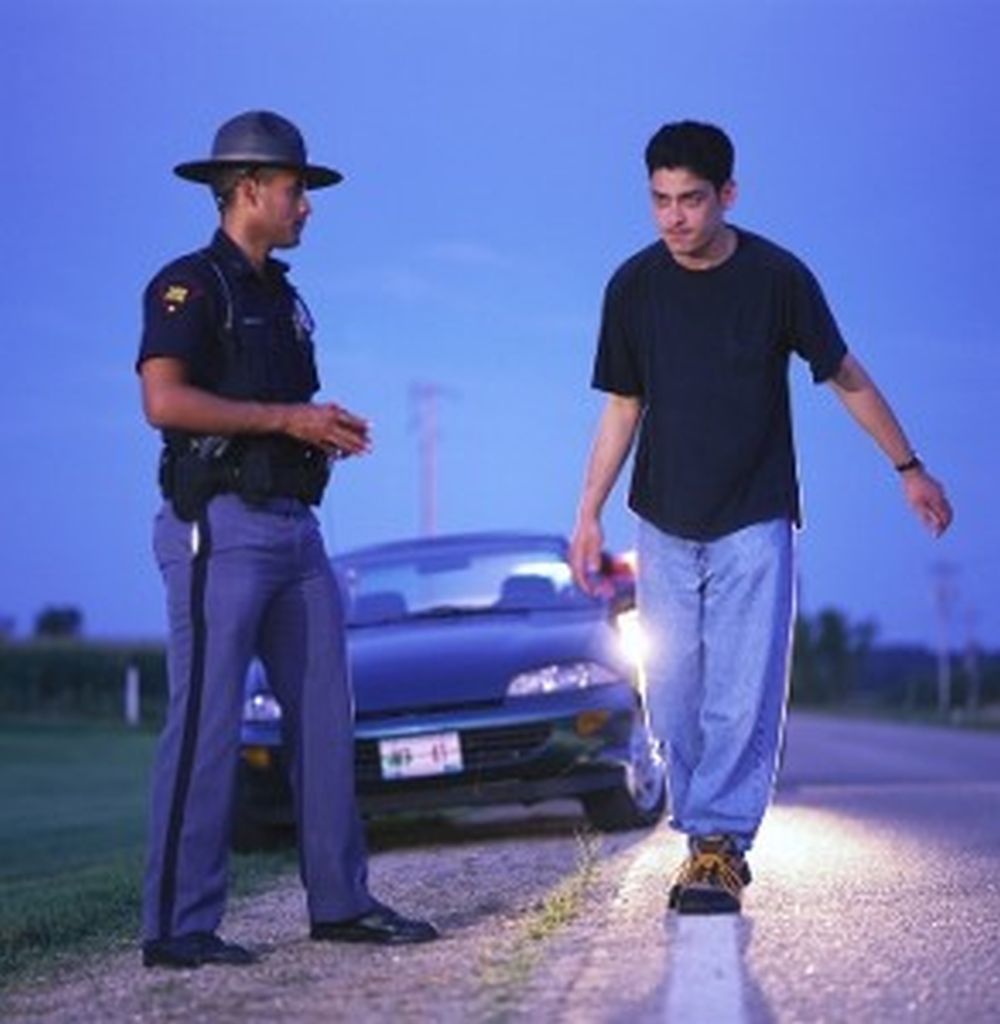

Finally, understand how your driving will affect insurance rates. Car insurance rates can always change and they are based on your driving record. Make sure you drive carefully and avoid any infractions on your record if you want to qualify for the best possible rates in the future.

So, there are a number of options when it comes to finding the right car insurance policy for young drivers. Doing research and understanding what factors are taken into consideration when determining your premiums is key in finding the best policy. By following these tips, young drivers can make sense of their car insurance options.

One of the best things young drivers can do to keep their insurance rates low is to remain accident-free. Practice safe driving whenever you get behind the wheel. Never drive under the influence and always wear a seatbelt! Obeying traffic laws and being cautious on the road will keep premiums from skyrocketing. Additionally, if you are able to go a few years without an accident, you could qualify for a good driver or loyalty discount.

Another way young drivers can save on their insurance is by being prepared for higher deductibles. Deductibles are the amount you have to pay before your insurance kicks in, and higher deductibles can significantly decrease insurance premiums. Make sure to factor in the cost of a higher deductible when budgeting for insurance.

You may also want to consider getting your car from a place that offers discounts based on the make and model of the car. Buying cars with higher crash test ratings can qualify you for discounts as this indicates that the car is built for safety and has less of a risk to be in an accident.

Its also important to keep insurance costs down by trimming unnecessary coverage. Ask yourself, Do I really need this coverage for the car Im going to purchase? Look for the coverage you need today and keep the coverage you dont need off your policy to save money.

It could also be beneficial to join an auto club or association in order to take advantage of special insurance discounts. If you are a student, you may be able to join a campus auto club and receive up to 10% off insurance premiums. Do your research and see if any other organizations you are a part of offer discount rates on car insurance.

Finally, if you think purchasing insurance directly from an insurance company is the way to go for you, make sure you shop around. Differences in cost between companies can be large, so in order to find the best deal you should do as much research as possible. Ask lots of questions and make sure you understand all of the details before signing a policy.

In conclusion, know the coverage you need, be prepared for higher deductibles, keep unnecessary coverage off your policy, join an auto club or association, and shop around to find the best deal. By following these tips, young drivers can make sense of their car insurance options and find the coverage they need to keep their premiums low.